Exploring the Future of Restaking: An Overview of the Leading Platforms

Restaking has emerged as a transformative approach to securing protocols, scaling ecosystems, and enhancing capital efficiency with more than $15B TVL in the last year. In a nutshell, Restaking allows validators to stake their assets to secure multiple protocols, all while contributing to a growing landscape of interconnected applications.

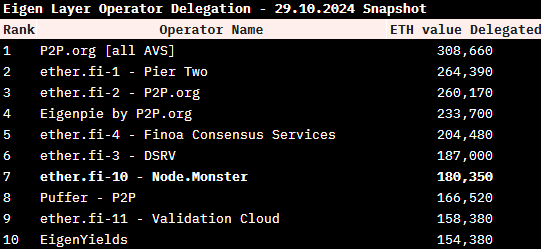

As a trusted validator across leading restaking platforms like Eigen Layer, Karak, and Symbiotic—and trusted by ether.fi—Node.Monster is positioned to deliver unique insights into these systems.

This blog delves into the three leading platforms — Eigen Layer, Karak and Symbiotic — pioneering unique restaking approaches. Though the high-level architecture across these projects is similar, each brings a distinct value proposition highlighting shared security’s potential. Key differentiators include enhanced protocol flexibility, support for multiple assets, and scalability across multiple chains.

Why Restaking Is Crucial

Restaking is redefining the way blockchain networks achieve security. By leveraging existing validator networks, restaking allows emerging protocols to access a reliable, decentralized security layer without the high costs of creating and maintaining a separate validator set. This shared security approach doesn’t just enhance capital efficiency; it accelerates the development of multi-chain ecosystems and enables protocols to interact across previously siloed blockchains.

With protocols able to tap into existing validators, new projects can benefit from the economic power of large networks like Ethereum, significantly increasing resilience and reducing risks of attack. This is especially crucial for projects in their early stages, which may not yet have the capital to attract a significant validator base. By enabling interoperability and decentralization, restaking fosters a new era in blockchain scalability, resilience, and capital optimization.

Restaking Top Platforms

Eigen Layer: Security and Customization on Ethereum’s Backbone

Eigen Layer is one of the first restaking platforms to integrate deeply with Ethereum, allowing protocols to leverage Ethereum’s validator network to secure their applications with ERC-20 restaked tokens. This Ethereum-centric design offers several distinct benefits:

- Ethereum-First Compatibility

Eigen Layer’s design prioritizes Ethereum-native projects by enabling projects to align with Ethereum’s trusted validator set, offering a high level of security without the need for independent validator infrastructure. This access to Ethereum’s security layer is especially appealing to new protocols, which can tap into Ethereum’s existing trust and decentralization without additional setup costs. - High Degree of Flexibility

Eigen Layer empowers protocols with the flexibility to customize their architectural components using smart contracts, including the consensus mechanism and slashing parameters. This allows developers to tailor protocol rules while enjoying Ethereum’s security backbone, accommodating protocols with unique governance and staking requirements. Each contract is independent, reducing dependencies between projects. - Increased Capital Efficiency

Stakers on Eigen Layer can restake their ETH, earning rewards across multiple protocols using the same capital. This model maximizes yield for validators, who can participate in various protocols without needing separate capital for each, thereby enhancing Ethereum’s appeal as a staking ecosystem.

Symbiotic: Permissionless, Modular Security for a Multi-Asset DeFi World

Symbiotic takes a more modular approach to restaking, distinguishing itself through its flexibility and support for multi-asset staking. By providing a permissionless and adaptable framework, Symbiotic appeals to DeFi protocols looking for customized, liquid security options.

- Customizable Security Parameters

Symbiotic’s modular design offers protocols granular control over security settings, such as collateral choice, slashing conditions, and node operator selection. This flexibility allows projects to adjust their risk and reward balances according to their specific security needs, making Symbiotic ideal for applications requiring a customizable security layer. - Immutable Core Contracts

Symbiotic’s foundational contracts are non-upgradeable, which minimizes governance risks by limiting centralization points. This immutability makes Symbiotic a trustworthy platform for protocols that prioritize long-term stability over frequent modifications, creating a more resilient DeFi ecosystem. - Permissionless Integration

With a fully permissionless framework, Symbiotic encourages decentralized participation, allowing any dApp to integrate without prior approval. This democratized approach fosters an open ecosystem and broadens access to shared security, appealing to a wide array of projects across the DeFi space.

Karak: Multi-Chain Restaking for Interoperable and Scalable Development

Karak is designed for multi-chain restaking, allowing projects to build beyond Ethereum and secure assets across various blockchains. This cross-chain focus positions Karak as a versatile option for protocols seeking interoperability and scalability.

- Multi-Asset Restaking

Karak’s multi-asset restaking allows validators to diversify their staking assets, creating a basket of collateral that reduces the risk of failure due to the collapse of any single asset. This diverse approach strengthens the security model, making Karak more resilient to market volatility. - Turnkey Development

Karak provides developers with a comprehensive set of tools for seamless deployment, making it easier for new projects to go live. This turnkey approach reduces technical barriers and shortens time-to-market, allowing developers to focus on building unique services without extensive infrastructure burdens. - Aggregate Cross-Chain Security

By spreading security resources across multiple blockchains, Karak’s architecture offers protocols a cross-chain aggregate security model. This decentralized structure benefits cross-chain applications by providing robust security against potential risks across different ecosystems.

Key Takeaways

- Eigen Layer: Designed for deep Ethereum integration, Eigen Layer provides flexible consensus and slashing mechanisms while optimizing capital efficiency within the Ethereum ecosystem. With its focus on ETH validator compatibility, it is well-positioned as the top choice for projects seeking robust security and scalability within Ethereum.

- Karak: Emphasizing multi-chain interoperability and multi-asset support, Karak delivers comprehensive cross-chain security, making it an ideal choice for protocols requiring security across both EVM and non-EVM ecosystems. Its cross-chain, multi-asset staking model positions Karak as a likely leader in the multi-chain restaking landscape.

- Symbiotic: Known for its modular, permissionless framework, Symbiotic supports ERC-20 assets with flexible, immutable core contracts that reduce governance risks. This permissionless and decentralized design makes Symbiotic particularly appealing to DeFi projects prioritizing flexibility and governance stability, establishing it as a strong player in the open DeFi ecosystem.

Liquid Restaking: Enabling Flexibility Across DeFi and Multi-Chain Ecosystems

The success of any restaking platform may be heavily influenced by its ability to attract Liquid Restaking Token (LRT) projects, as LRT brings stakers enhanced flexibility and security. Liquid restaking allows stakers to retain asset liquidity while supporting multiple security layers, creating a “liquid security layer” that benefits multiple protocols. Leveraging the cross-chain design of restaking platforms, LRT enables seamless movement across networks, making it an ideal asset in a multi-chain DeFi landscape.

With rewards from various protocols, flexible collateralization, and yield optimization vaults, LRT keeps users engaged by providing diversified returns. This appeal to DeFi users, who prioritize capital efficiency, liquidity, and cross-chain functionality, positions LRT as a leading force in DeFi. Platforms that can effectively attract and integrate LRT projects may gain a strategic advantage, reinforcing their role as essential infrastructures in the evolving restaking ecosystem.

To read more on the rise of LRT projects, we recommend Node Capital’s article: Abstracadabra: The Liquid Restaking Over

Conclusion

Restaking has laid a solid foundation for blockchain security, but the landscape extends far beyond Eigen Layer, Karak, and Symbiotic. New projects are continuously innovating, introducing layers that boost resilience, adaptability, and appe\al to both DeFi and traditional finance. For instance, Strategy Vaults enhance staking returns through optimized, yield-boosting strategies, while Additional Chain Support from projects like SatLayer on Bitcoin and Solayer on Solana expand cross-chain staking options beyond the EVM ecosystem. Active Validator Services (AVSs) bring novel security models for decentralized computing and real-world asset integration, and Stacks like Othentic provide production-ready components that streamline development, reduce overhead, and support rapid deployment.

These diverse, interconnected layers demonstrate that restaking is evolving into a multifaceted security ecosystem. As platforms grow and collaborate, understanding the synergy between these layers will be crucial to unlocking new levels of scalability, resilience, and potential that can attract both DeFi and traditional finance players to blockchain’s shared security models.